-by our correspondent.

The Federal High Court sitting in Abuja has adjourned to April 15, 2021 the case between the Federal Government of Nigeria and Dantata Success and Profitable Company (DSPC) and four others.

The company and its promoters were last year charged before the Federal High Court in Abuja for investment fraud amounting to over N2billion. Those charged along with the company are Basira Ibrahim Dantata, Lawan Sanni and Gaji Ibrahim Dantata.

The defendants who were arraigned before Justice A. I Chikere of Federal High Court 3, were alleged to have planned to defraud about 7,250 investing public between 2018 and 2019, within the jurisdiction of the court, by asking them to subscribe and invest in an unregistered investment scheme amounting to over N2 billion.

According to the charge, the accused committed an offence contrary to Section 54 of the Investments and Securities Act 2007 which is punishable under same section. When the matter came up in court Wednesday, one of the defendants Gaji Ibrahim Dantata was not available due to health reasons and Justice Chikere had to adjourn the matter to April 15, 2021 for plea and motion filed by the defendants.

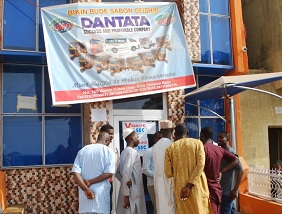

Recall that the Securities and Exchange Commission (SEC), pursuant to its powers under the Investments and Securities Act (ISA), 2007, had on February 6, 2019 sealed up the business premises DSPC, alleging that the company had been engaging in illegal activities in the Nigerian capital market, the Commission also obtained court orders to freeze the bank accounts of the company to preserve the funds of investors in line with the provisions of ISA 2007.

In a statement SEC said “the company was not registered or authorized by the Commission to engage in any activity in the capital markets, however it targeted and reached Nigerian investors through radio programs in the Kano area of Nigeria and collected large sums of money from investors under the guise of a “structured investment”.

According to the statement, “The activities of the company contravene the provisions of Section 38(1) and 67(1) of the Investments and Securities Act which respectively, prohibit unregistered and unauthorized entities/persons from operating any investment business or making any invitation to the public to acquire or dispose of any securities of a body corporate or to deposit money with anybody corporate for a fixed period or payable at call.”

The Commission also issued a warning to the public to exercise utmost caution before deciding to subscribe to investment schemes noting that DSPC and other individuals representing them are not registered and therefore not entitled to provide investment advisory or services in Nigeria.

Comment here