-by Barnabas Esiet.

Prelude

Privatization is variously defined to mean… variety of measures adopted by the government to subject a public enterprise to competition through private ownership for proper management and control to lessen the burden of government spending.

The Privatization and Commercialization Act of 1988 and the Bureau of Public Enterprises Act of 1993 define privatization as the relinquishment of part or all of the equity and other interests held by the Federal Government or any of its agencies in enterprises whether wholly or partly owned by the Federal Government.

However, in general, privatization infers the transfer of the ownership of a public enterprise to private investors; it is mainly a divestiture of government economic activities.

This is the sense in which the term has been officially defined in Nigeria different from other forms of public enterprise privatization in the socialist or centrally controlled economics where it takes the forms of allowing individuals to own and control economic activities

A public enterprise is a form of corporate organization that is owned by the government either partly or fully. There are different types of public enterprises such as public corporation, departmental undertaking and Government companies such as: the Nigerian National Petroleum Corporation (NNPC), Nigerian Ports Authority (NPA), Nigerian Postal Services (NIPOST), and the Nigeria Railway Corporation (NRC) among others.

Commercialization refers to the reform of an enterprise wholly or partly owned by the government towards self-sufficiency with minimum government intervention and control, sometimes in preparation for privatization.

Setting

There was a time in Nigeria when it was considered a sound economic policy for the government to invest in statutory corporations and state-owned enterprises. Then it was reasoned that public companies were better funded for stimulating economic growth and development than private enterprises.

Government then floated enterprises in different sectors of the economy ranging from banking and insurance, oil & gas, automobile, hospitality and many more.

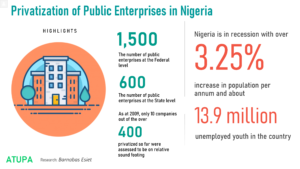

The oil boom of the 1970s provided the financial muscle for the government to fund these enterprises. Available data indicates that about 1,500 and 600 public enterprises at the federal and state levels were established in Nigeria as at 1991.

The public enterprises were then seen as important vehicles to quicken national development, integration and rapid economic growth in order to raise the standard of living of Nigerians.

Against these expectations, however, public enterprises were later regarded as poor investment choices associated with inefficient management and defective capital structure, gulping huge operation and maintenance budgets and above all constituting a big burden on the federal purse as a result of misallocation of funds and corruption.

Following the perceived problems associated with public enterprise such as inefficiency and wastages resulting from the feeling that government’s property belongs to nobody, it became obvious that the government could no longer continue with the scheme.

As part of an effort to check the mismanagement of public enterprises in Nigeria, the President Olusegun Obasnjo regime in 1999 introduced a policy on privatization intended to make Nigeria the hub for both local and international investors.

The government then set up the National Council on Privatization, overseen by the then Vice President, Attiku Abubakar, to implement the programme through the Bureau of Public Enterprises (BPE) in line with the Public Enterprises Act of 1999.

The BPE is the secretariat of the National Council on Privatization (NCP) and is responsible for implementing the council’s policies on privatization and commercialization.

So far, the BPE has privatized many public companies including; NITEL, Sheraton Hotel, Lagos International Trade Fair complex, 17 successor companies of (PHCN) and the National Aviation Handling Company (NAHCO), among others.

Whose interest?

Many believe that ownership or control of management of public enterprises would be better in private hands than government.

Privatization is seen as an attempt to turn around the enterprises so that they can deliver goods and services more efficiently and effectively and also to reduce spending taxpayers money on unproductive ventures.

Some have, however, argued that this kind of reasoning is ideologically inclined and cannot be substantiated by the current reality in Nigeria where for instance, some of the already privatized organizations, such as the PHCN, have failed to meet the expectations of Nigerians.

Opponents of the policy, in third world countries like Nigeria, say often the government does not provide a well thought out privatization framework to guarantee equitable distribution of ownership and proper management control for the protection of the original owners – the citizens – from monopoly.

Secondly, analysts believe that just changing from public ownership to private ownership does not guarantee that the companies would do better as they are usually sold to cronies who sometimes do not have the requisite competencies to run the firms effectively for the benefit of the masses. Privatizing some of the public utilities can also deprive citizens from enjoying the affordable social services they provide.

Other critics say the sale of these national assets often place the few successful buyers in monopoly power making it difficult to achieve equitable distribution of ownership to the various income and occupational groups in the economy.

There had been insinuations that some of the public enterprises may have been deliberately under-valued and sold to privileged people who are in pole positions to buy and control them privately to the detriment of the masses.

The sale of former PHCN successor companies to power Distribution Companies in Nigeria is a familiar case.The sale which was expected to boost power supply and ignite competition for efficiency and fairer tariff regime, seems not to have achieved the desired outcome many years after they were privatized.

Learning Curve

There is no doubt that the government has to let go its direct involvement in some unproductive sectors of the economy, except for regulatory purposes. The oil industry for instance has witnessed colossal wastage of taxpayers money by way of government subsidies and mismanagement of government run refineries.

Government has continued to manage this sector despite experts’ advice against such, owing to vested interests and political reasons.

The chief Executive officer of the Nigeria Stock Exchange, Oscar Onyema, believes that privatization provides the avenue for increased productivity by creating productive entities that drives the economy citing the example of the benefits of the telecoms sector which contributed 11.39% to Nigeria’s GDP in 2019.

Chief Executive, NSE, Oscar Onyeama

“Privatization relieves the government from the burden of funding unproductive public enterprises and provides liquidity for government; it also plays a key role in poverty alleviation, security and job creation.” He noted

Despite the aforementioned benefits of privatization,however, the former Director General of BPE, Dr. Christopher Anyanwu, painted a different picture while decrying the various technical deficiencies that have ruined the privatization programme. According to him, as at 2009, “only 10 out of the over 400 companies privatized were assessed to be on relative sound footing.”

Many have, however, questioned the value realized from sale of public enterprises compared to the current needs of the country that is in recession, with over 3.25% increase in population growth per annum and about 13.9 million unemployed youths.

The idea behind privatized institutions is to make them efficiently provide essential products, create employment for the teaming youths and enhance economic growth, but these have been farfetched.

Olisa Agbakoba is a Senior Advocate of Nigeria, former President of Nigeria Bar Association and the current Chairman National Arbitration Committee. He believes that the Nigerian model of privatization is unfair as it only enriches people at the top at the expense of the masses.

Chairman National Arbitration Committee,Olisa Agbakoba

“I believe in a model of privatization that is inclusive and allows for the elevation of the poor class.” He argued.

It appears governments at the federal and state levels are more interested in what the sale of these public enterprises can generate to augment their revenue shortfalls in the short run without considering the immediate and long term effects of handing these companies over to the wrong hands .

There’s now growing calls by state governors for privatization of state owned enterprises at the subnational level owing to the exigencies of time brought about by dwindling internally generated revenue, federal allocations and the covid-19 pandemic.

According to Ekiti State governor, Kayode Fayemi, ”state governors are experiencing severe economic challenges which are significantly different from what used to be normal, they now have to re prioritize their annual budgets as the states are compelled to increase public spending, setting up screening and testing centers, paying health care workers and providing tax relieves.”

For the Director General of the Securities and Exchange Commission, SEC, Lamido Yeguda, “There is indeed no better time to discuss alternative sources of generating revenue for the state than now, the ability of states to borrow has been limited by less allocation and depressed internally generated revenue.”

Director-General SEC,Lamido Yeguda

Financing budget deficits with proceeds of sales of public enterprise seems a temporary measure, as one is tempted to ask; what then happens after all the public enterprises have been sold?

Some analysts believe that it’s time for a complete paradigm shift to ensure continuous flow of revenue and for government to rely less on borrowings and sale of strategic state enterprises by focusing more on boosting production of goods and services for export that could fetch the needed foreign exchange, to grow the nation’s foreign reserves and correct balance of payment deficits.

These they believe would bring greater benefit to the majority of the populace.

**This report was facilitated by the US Embassy and Civic Hive through the Atupa Fellowship Programme.

Comment here