-by Barnabas Esiet

Some of the major rates in the Nigerian financial sector that determines money flow in the economy will remain the same as in the previous month for the month of January 2021.

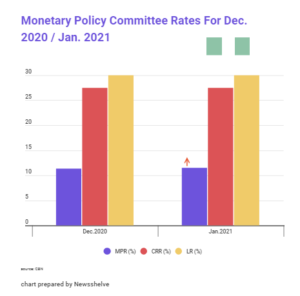

This follows the Monetary Policy Committee (MPC)’s decision, after a two-day meeting in Abuja, to retain the Cash Reserve Ratio (CRR) and the Liquidity Ratio (LR) at 27.5 percent and 30 percent in that order.

The Governor of CBN, Godwin Emefiele, who presided over the meeting said the committee decided to peg the Monetary Policy Rate (MPR), which is the basis for all other interest rates in the economy, at 11.5 percent while the CRR and LR remain the same as that of November last year at 27.5 per cent and 30 per cent respectively.

Some Market analysts believe that the MPC’s decision to retain the rates could have been informed by the relative stability in the market over the review period, while a few others said further tightening could have help to curb rising inflation that is weakening the local currency.

The MPC was established by the Central Bank of Nigeria Act (2007) to facilitate the attainment of the objective of price stability and to support the economic policy of the Federal Government through the formulation of appropriate monetary and credit policies.

Comment here