By Barnabas Esiet.

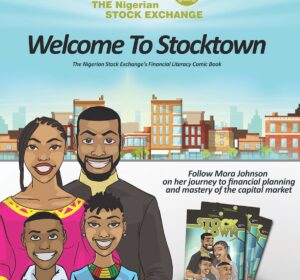

Nigeria’s leading bourse, The Nigerian Stock Exchange (NSE or The Exchange) has issued the second edition of its comic, StockTown, dedicated to providing financial literacy education to Nigerians.

In a statement, the NSE said proliferation of dubious investment schemes that often result in loss of money by unsuspecting members of the public continues to make the role of financial literacy imperative.

The comic, available in digital format on a dedicated website at www.nse-stocktown.com builds on The Exchange’s advocacy for safe and trusted investment schemes.

The story picks up from the first edition, following the life of Mora Johnson as she seeks to liberate her family from their financial struggles by investing in the capital market.

This second edition highlights some major lessons for potential and existing investors including the need for vigilance in avoiding Ponzi schemes and unregulated investments, whilst advising prospective investors to seek proper guidance before making investment decisions.

NSE Head, Corporate Communications, Olumide Orojim

The Exchange’s Head, Corporate Communications, Olumide Orojimi, underscored the significance of the comic book to investors. “Investor Education is a priority for us at The Exchange, we have identified the need to empower individuals across all levels to make good financial decisions and better their lives now and in the future.” He said.

“As the investment landscape continues to evolve to accommodate more retail participants, we are excited to leverage new and existing platforms to present investment products and processes in ways that are both appealing and easy to understand, particularly in this new normal.” Orojimi added.

NSE is a member of the Financial Literacy Technical Committee of the Securities and Exchange Commission (SEC); as well as the National Finance Inclusion Steering Committee led by the Central Bank of Nigeria with a mandate to reduce the level of financial exclusion in Nigeria to 20%.

Comment here