Lagos Chamber of Commerce and Industry (LCCI) says the Nigerian economy is still burdened with inflation, poor infrastructure and foreign exchange difficulties among other limiting factors.

In a statement signed by the Director-General LCCI, Dr. Chinyere Almona, the organised private sector body noted that the Nigerian economy has recorded impressive recovery from the recession induced by the COVID-19 pandemic in 2020 with consistent growth rates breaking many analysts’ predictions of expected lower growth rates.

It, however, stated that the economy has continued to struggle despite the impressive growth with ‘many inhibiting burdens like inflation, weak revenue generation, degenerated infrastructure, forex challenges, and unsustainable cost profile seen in debt services and subsidy payments, and the daunting threats of worsening insecurity.’

The Chamber expressed concerns that the economy may run into a stagflation which will impact on production cost, job losses, worsened forex crisis, and dampened growth in the medium term if the current trend continues.

Dr. Almona advised the government to increase its funding interventions selected non-oil sectors like agriculture, manufacturing and export to boost productivity and foreign exchange inflows. She also urged the government to deal decisively with oil theft, subsidy removal and increasing debt burden in the country.

The statement read in part, “The National Bureau of Statistics (NBS) announced that Nigeria’s Gross Domestic Product (GDP) grew in 2022 Q2 by 3.54% year-on-year in real terms. This is the seventh quarter of positive growth. This rate is lower than the 2021 Q2 rate which was at 5.01% decreasing by 1.47%.

“Quarter-on-Quarter, it was an increase of 0.44% points relative to 3.11% recorded in 2022 Q1. While we celebrate the latest growth figures, the Chamber wishes to highlight some threats to future growth that need special attention:

“The oil sector has consistently recorded negative growth for the ninth consecutive quarter, contracting again by -11.8% y/y in Q2 2022 following a higher contraction of -26% y/y in Q1.

“The average daily crude oil production in Q2 was 1.43mbpd even lower than 1.49mbpd produced in Q1. If oil revenue makes up more than 80 percent of government revenue, we expect the Government to tackle the menace of oil theft and pipeline vandalism with sterner approach.

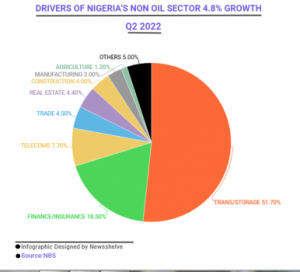

“The non-oil sector grew by 4.8% y/y in Q2 ’22 against 6.1% y/y in Q1 ‘22. Key drivers within the non-oil economy include transportation and storage (51.7% y/y), finance and insurance (18.5% y/y), telecommunications (7.7% y/y), trade (4.5% y/y), real estate (4.4% y/y), construction (4.0% y/y), manufacturing (3% y/y), and agriculture (1.2% y/y).Combined, these sectors account for 78.3% of total GDP in Q2.

“The growth of 1.2% recorded for agriculture and the 3% for manufacturing are comparatively low when compared with other sectors that grew at above 5%. This is also indicative of the threats facing these sectors that power Nigeria’s real sector.

“The woes in these two sectors are responsible for the frightening rise in our inflation rate. And with the excruciating burden from debt service, subsidy payments, and worsening insecurity, many more production activities may be constrained in the coming months.

“We urge the government to continue with the non-oil campaigns and interventions to sustain the targeted financing towards boosting non-oil export for enhanced foreign exchange earnings.

“The Federal Government needs to sustain its targeted interventions in selected critical sectors like agriculture, manufacturing, export infrastructure, tackling insecurity, and free more money from subsidy payments.

“It is also worrisome that the 2023 budget estimations indicate that there may not be any significant allocation to capital projects in 2023. We urge the government to tackle oil theft to earn more foreign exchange, borrow from cheaper sources to reduce the burden of debt servicing, and take a decisive step towards removing fuel subsidies.”

Comment here