The manufacturers Association of Nigeria (M.A.N) says the Nigerian economy has been showing continued signs of improvement in last six quarters from 2021.

In a recent report, M.A.N said that its Manufacturers CEO’s Confidence Index (MCCI) has remained above the baseline of 50 points during the period under review, indicating an improvement in Manufacturers’ growing confidence in the nation’s economy.

The MCCI is a quarterly research and advocacy publication of M.A.N, which measures changes in pulse of operators and trends in the manufacturing sector quarterly, in response to movements in the macro-economy and Government policies, using primary data mined through direct survey on over 400 Chief Executive Officers of MAN member-Companies.

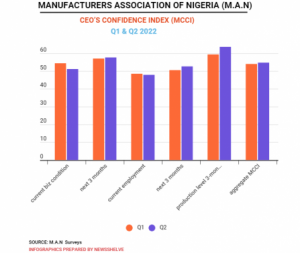

MCCI Index is computed using data generated on standard diffusion factors of Current Business Condition, Business Condition for the next three months, Current Employment Condition (Rate of Employment), Employment Condition for the next three months and Production Level for the next three months.

The Index has a baseline score of 50 points and scores above the baseline indicate improvement in manufacturers’ confidence in the economy, while index score of less than the baseline suggests deterioration in the operating environment.

According to the report, In the Second quarter of 2022, the MCCI marginally increased to 54.6 points up from 53.9 points recorded in the first quarter of the year, despite the plethora of challenges including poor access to Forex for importation of raw materials not available locally, effect of rising global inflation…

Aggressive drive for revenue by Government, frequent collapse of the Grid, increase in price of diesel, scarcity of wheat and other manufacturing inputs due to the ongoing war in Europe and wide spread insecurity that combined to limit productive activities in the economy during the quarter.

“The afore-mentioned meagre improvement in the index score in the second quarter of 2022 implies that manufacturers’ confidence in the economy slightly improved above what obtained in the preceding quarter.

“Signifying that manufacturers responded to the economic challenges that prevailed in the quarter with appropriate survival strategies and adjustments including remodeling of production operations, after the marginal slowdown experienced in the first quarter.” The report read.

The increase in the Aggregate Index score was attributed to the feedback on the anticipated improvement in business condition, employment condition and production level in the third quarter of the year.

The report read in part: “Noteworthy, is the fact that business condition in the quarter under review was more challenging than what obtained in the first quarter of the year just as employment condition worsened.

“Nevertheless, the operating environment in the quarter under review was fairly better than the condition in the preceding quarter due to compelling adjustments made by Government, manufacturers and households in response to general increase in price, forex shortage, increasing cost of energy, scarcity of raw materials and many more, thrown up by the war in Europe.

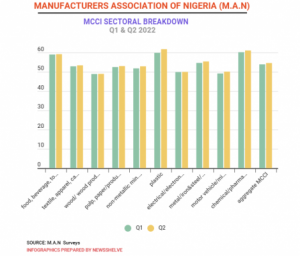

“Findings from the sectoral analysis shows that Index score of Wood & Wood Products sector is 49 points in the second quarter of the year, which is a marginal uptick from 48.9 point obtained in the first half of the year, even though it is below the 50 baseline points.

“The index score of Electrical & Electronics group improved to 50 points from 49.9 points obtained in the preceding quarter. The index of the Motor Vehicle & Miscellaneous Assembly moved above the baseline to 50.1 points from 49.2 points of the preceding quarter.

“Based on the above backdrop, activities in the Wood & Wood Products and Electrical & Electronics sectoral group signaled an improvement over the results of the first quarter despite the fact that the operations of the groups were most impeded by unfriendly operating environment.

“However, the Motor Vehicle & Miscellaneous Assembly group appeared to be gradually finding its footing back after operational difficulty in the first quarter of the year.

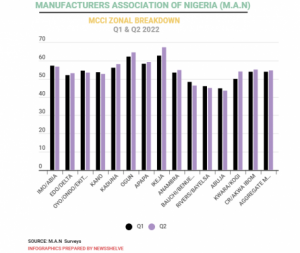

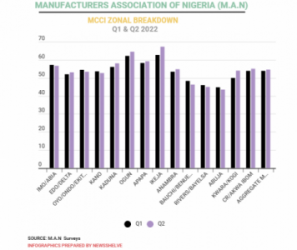

In the quarter under review, observations from analysis on industrial zones activities shows that operating environment in the zones within the Middlebelt and Rivers/Bayelsa zone was the toughest during the quarter under review.

The index score of Bauchi/Benue/Plateau fell below the 50 points baseline at 46.3 points from 48.3 points recorded in the first quarter of the year.

Likewise, Index score of Abuja zone also declined to 43.5 points from the 44.8 points in the first half of the year. River/Bayelsa scored 45.0 points, which fell short of the 46.0 points recorded in the first quarter.

“The Middle belt that houses Bauchi/Benue/Plateau industrial zones appears the most unsettled region owing to insecurity challenge in the country.

“As a result of the situation, a number of companies in the zone operated at sub-optimal level, while other have either shut down operations or relocated to a safer environment.

“The affected companies experienced severe stockout of primary raw materials, particularly agro-allied as most of the farmer had taken to their heels due to insurgency.

Manufacturing and other business activities in the Rivers/Bayelsa zone appears to be struggling with the impact of aggressive drive for internally generated revenue by Government to bridge revenue gaps occasioned by the divesting activities of International Oil Companies from hydrocarbon to renewable energy sources.

M.A.N attributed the number of induced investment in the area to the huge autonomous investment in crude oil business in the zones.

In conclusion, the report noted that the effect of the Russian-Ukrainian war has affected manufacturing activities and the local economy while calling on the government to initiate palliative measures to cushion the negative effects on the Nigerian economy.

“The Russian-Ukrainian war has clearly underscored the popular maxim that the world has become a global village. The occurrence of an incidence in a part of the world, notwithstanding how specific we may think, can actually become a global issue.

“Therefore, apart from the need for ardent management of global peace, the series of global occurrences and the lessons learnt demand that national Governments should begin to take drastic measures to manage these phenomena proactively going forward.

“Undoubtedly, phenomena such as the China-America trade war, the Asian and Global Financial crises, the challenges thrown up by COVID-19 pandemic and now, the Russian-Ukraine war call for the development of a sustainable national anticipatory policy measures.

“Clearly, the resultant effects of these challenges continue to manifest in the escalation of global inflation, shortfall in the global supply chain followed by the rise in energy cost, fertilizer and fertilizer inputs, wheat grain, etc.

“Cumulatively, these challenges interplayed to shape the direction of performance of the manufacturing sector in the second quarter of 2022.

“It is therefore important for the Government to intentionally create an anticipatory policy framework that will facilitate automatic stabilization of the economy in the event of domestic or global shocks, while addressing the afore-mentioned familiar operating challenges limiting the performance of the sector.”

Comment here