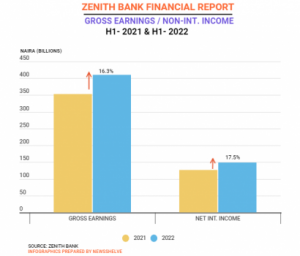

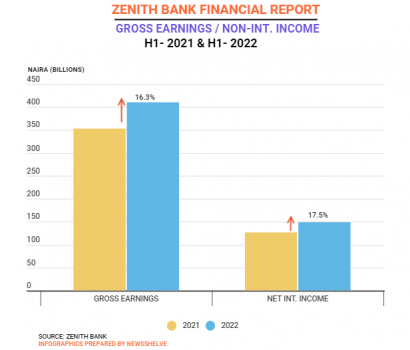

One of Nigeria’s leading lender, Zenith Bank Plc. grew its gross earnings to N410.35B in the first half of 2022 indicating 16.3% leap when compared to the N352.90b earnings recorded in the corresponding period of the previous year.

Zenith Bank’s non-interest income also grew by 17.5% from N126.77b recorded in half year 2021 to N148.98b in the current period.

According to the Bank’s interim financial report released on Tuesday, the performance was driven by a combination of core and non-core income growth as the bank benefited from the improved interest rate environment.

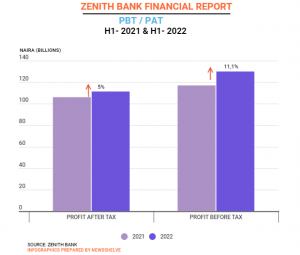

Consequently, zenith Bank recorded an Earnings Per Share (EPS) growth of 5.0% to N3.55 y/y compared to N3.38 in half year 2021.

The bank also saw 18.5% y/y growth in interest income, which stood at NGN241.73 billion with the strong growth supported by an expansion in income from loans and advances to customers at N163.41B reflective of its increased risk appetite.

This is attributed to the gains in investment securities (+43.7% y/y to NGN85.19 billion) and expansion in fees and commissions income (+35.2% y/y N64.45 billion). In addition, the aforementioned offset the loss in net foreign exchange revaluation of N6.25 billion. As a result, the impressive NII expansion, alongside the growth in net interest income, led to a 15.6% y/y increase in operating income to N308.61 billion.

Operating expenses expanded by 19.2% y/y to N178.60 billion, aided by regulatory charges comprising; NDIC insurance premium (+21.2% y/y to N9.78 billion), AMCON levy (+16.1% y/y to N44.01b and personnel expenses (+5.7% y/y to N39.74 billion).

Notwithstanding the adverse headwinds, profitability was stronger, as profit-before-tax (PBT) appreciated 11.1% y/y, while profit-after-tax (PAT) increased moderately by 5.0% y/y to N111.41 billion, given the higher income tax expense (+69.9% y/y to N18.59 billion).

Analysts say the performance during the period under review was impressive as it aligned with the bank’s expectations.

According to Cordros Capital Ltd, “the strong growth in core and non-core income is very positive and should allow operating income growth to trail expense growth, which is expected to remain under pressure due to spiraling costs. Overall, this should allow the bank recorded stronger profitability year-on-year.”

Comment here