By Barnabas Esiet.

Guaranty Trust Holding Company (GTCO), one of Nigeria’s largest lenders, is raising ₦400 billion in capital through a public offer anchored on the Nigerian Exchange Group (NGX).

The company is offering 9 billion shares at ₦44.50 each, with plans to invest the additional capital in profitable ventures in West Africa and East Africa, as well as recapitalize GTBank Nigeria, expand its asset management and pension businesses, and grow its loan portfolio.

According to Group CEO Segun Agbaje, GTCO has a track record of delivering strong returns, with a 29% average return on equity (RoAE) over the past ten years and a 253% return on investment over the same period.

The company has also made significant inroads into non-banking businesses, including fintech, asset management, and pension management, with plans to generate 5% of group profit from these businesses within three years.

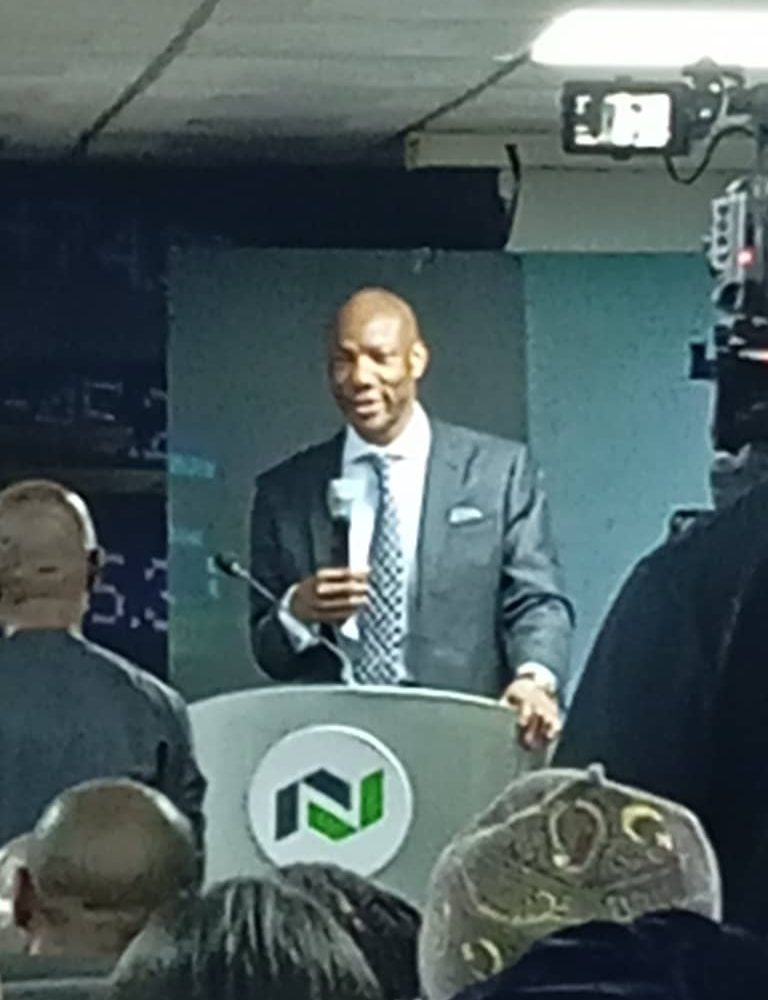

Agbaje, in a “fact behind the offer” presentation at the NGX on monday, gave stakeholders compelling reasons to embrace the offer. He promised to soon make GTCO the first Nigerian company to realise a billion dollar profit.

He welcome the CBN directive to banks in Nigeria to upscale their capital threshold, following adverse economic headwinds that have seen continuous erosion of assets noting that GTCO already had plans to raise fresh capital months before the directive.

With a market capitalization of ₦1.39 trillion, GTCO is one of the largest and most profitable companies listed on the NGX, accounting for approximately 9% of stocks traded on the exchange.

Comment here