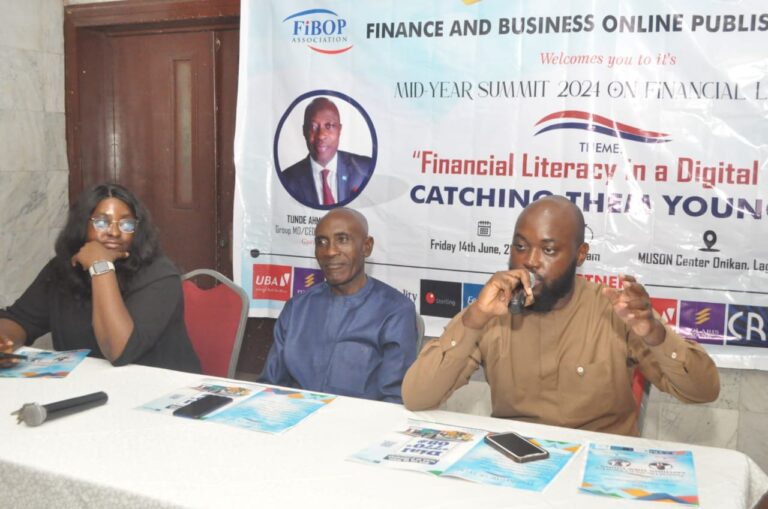

In its drive to inculcate financial discipline in youths, the Financial and Business Online Publishers (FiBOP) recently hosted a transformative conference in Lagos for Nigerian students.

The event, held at the Muson Centre, Onikan, Lagos, was supported by leading financial institutions including UBA, Polaris Bank, Fidelity Bank, Access Bank, Sterling Bank, CRC Credit Bureau, Chivita limited and the TinCan Island Port Command of the Nigeria Customs Service.

The conference with the theme: “Financial Literacy in a Digital Era: Catching Them Young,” which drew participants from secondary schools across Lagos, highlighted the significance of financial discipline from a young age and shaping habits that will influence the students’ future endeavours.

GMD/CEO of CRC Credit Bureau, Dr. Tunde Popoola represented by Osasikemwen Ighilen engaged the students with discussions on their future aspirations. Many of the students having indicated their desirs to own businesses of their own, she emphasied that such ambitions could only be realized through prudent saving habits early in life.

Ighilen highlighted the importance of saving small amounts regularly and making it into a lifelong habit.

She stated, “Save gradually, and it will eventually become a culture in your lives as you grow older,” said Ighilen.

The CRC spokesperson encouraged the students to save part of their daily pocket money, suggesting they use personal piggy boxes if they found it challenging to save with their parents.

“No amount is too small to save. Anyone who does not discipline themselves by saving small amounts will struggle to save larger amounts in the future,” she added.

Dan-Preston Nwaokorie, representing the MD/CEO of Fidelity Bank, Nneka Onyeali-Ikpe, underscored the necessity of sound financial management from an early age. He advised the students to avoid reckless spending while highlighting the importance of forming good saving habits early in life..

“Financial responsibility is essential for everyone, including young ones, to lead a well-planned life,” said Nwaokorie.

Charles Onwuatogwu, President of FiBOP, who delivered a welcome address explaining the summit’s theme, emphasized the importance of raising financial awareness among secondary school students and stressed the need to equip them with the necessary skills for efficient funds management.

“The summit aims to benefit participants by inculcating a culture of savings, investment, and efficient resource utilization,” said Onwuatogwu.

He highlighted the summit as a platform for policymakers and financial experts to discuss money management fundamentals and new developments in financial education.

Onwuatogu stated, “We strongly believe that early financial education is crucial for the development of sound financial habits that will benefit these youths throughout their entire lives,”

The FiBOP President called on the federal government to integrate financial studies into the senior secondary school curriculum, noting that enhanced financial literacy could reduce fraud and improve financial management skills nationwide.

He acknowledged the support of UBA, Polaris Bank, Fidelity Bank, Access Bank, Sterling Bank, CRC Credit Bureau, Chivita and the Nigeria Customs Service for their pivotal roles in the success of the event.

By partnering with these esteemed institutions, FiBOP aims to contribute to the growth and development of Nigeria’s financial economy, ensuring that the next generation of Nigerian youths is well-equipped to navigate the complexities of financial management in a digital era.

This summit represents a significant step towards achieving greater financial literacy among Nigerian youths, fostering a generation that is financially savvy and prepared for the future.

Comment here