A financial analyst has expressed doubts that the intentions of the Central Bank of Nigeria (CBN), to significantly reduce the number and percentage of adult Nigerians excluded from the formal Financial System of the country, would yield the desired impact on the nation’s Economy.

The CEO, Bank Customers Association of Nigeria, Dr. Uju Ogubunka, made his views known at a forum organised in Lagos recently by the Oriental News Nigeria with theme: “Engaging with critical groups to develop effective financial inclusion initiative”

Dr. Uju Ogubunka said the financial inclusion policy of the federal government was implemented in 2012 towards ensuring that no Nigerian is short changed in its financial intermediations policies and economic development plans.

He, however, noted that out of the 84 percent financially excluded population then, the government targeted to achieve only 20 percent inclusion by year 2020.

“The adult population has now increased above 84 percent and the unbanked population has also increased remarkably. If the people are outside the financial system, the economy will not develop” Ogubunka stated.

He analyzed the process of financial inclusion in the country from inception of the program and submitted his verdict on implications for the financial system and the economy.

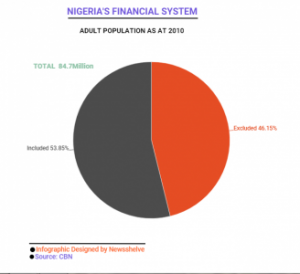

“As some of us will remember, the CBN initiated the National Financial Inclusion Programme in year 2012 that is, about a decade ago. The Programme is kind of a response to the discovery from a study in 2010 that about 39.2 million or 46.3% of the then 84.7 million adult population in the country were excluded from the formal Nigerian Financial System.

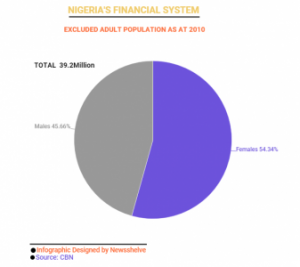

“That meant that 45.5 million or 53.7% of the 84.7 million were included in the system. It was also noted that of the excluded 39.2 million adult Nigerians, about 21.3 million or 54.4% were females; meaning that about 17.9 million (i.e. 45.6%) were males.

So, females accounted for a higher number and percentage of the excluded than males. On the other hand, males accounted for a higher number and percentage of those included in the Nigerian Financial System.” he stated.

Ogubunka, pointed that the figures above show that there would be adverse consequences for the financial system and the economy, especially as almost half of the financial resources in the country were in the hands of people operating outside the formal financial system.

In his words: “Consequent on the foregoing, the CBN saw the need to redress it, thus, it floated the Financial Inclusion programme and supported it with a Strategy Document tagged ”National Financial Inclusion Strategy” that encapsulated, among many other things, the Strategy Objectives, Strategy Stakeholders and their Interests, and Key Financial Inclusion Targets.

“The initiative targeted a reduction of the rate of the excluded from 46.3% to 20% come year 2020. ( i.e. a reduction of 26.3%), meaning that the percentage of the included would rise to 80% from 53.7% within the same period.”

Comment here