Ecobank Transnational Incorporated (ETI) has remarkable performance in all the key financial indices in the first quarter ended March 31st, 2021. According to the unaudited results for the period under review, the Pan African Bank recorded a Profit Before Tax (PBT) of N40.3 billion, representing 22% increase over the N33 billion reported in the corresponding period of 2020. Profit After Tax (PAT) stood at N30.5 billion.

Analysis of the result submitted to the Nigerian Stock Exchange reveals that the Bank grew its Gross earnings to N214.3 billion, up by 10% when compared to the N194.9 billion recorded during the same period in 2020.

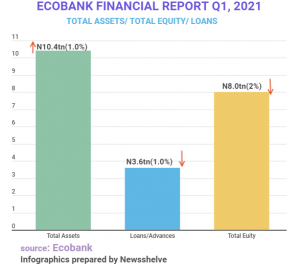

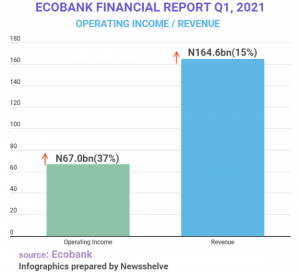

Similarly, Revenue went up by 15 per cent to N 164.6 billion; Operating Income before impairment losses also appreciated by 37% to N 67.0 billion while Total Assets spiked 1.0% to N 10.4 trillion. However, Loans and advances to customers went down by 1.0 % to N 3.6 trillion as Total Equity also reduced by 2% to N8 trillion

.

.

Analysts say the remarkable improvement in the Bank’s financials despite global economic challenges can be attributed to its digital platform and innovative products and services. Ecobank Group CEO, Ade Ayeyemi believes that the increase in patronage of the Bank’s reliable platforms is a major contributing factor to the growth.

In his words: “We are focusing on achieving execution momentum in our payment business, the sustained reliability of all our platforms, driving increased adoption of our products and services, bringing our NPL ratio low and exceeding the expectations of our customers to truly be the pan-African Bank that Africa trusts”.

Ecobank Group CEO, Ade Ayeyemi

“These, together with all our investments and achievements to date, will enable us collectively grow revenues and generate long-term return of capital to our shareholders, despite the near- term challenges from COVID-19.” He said.

Comment here