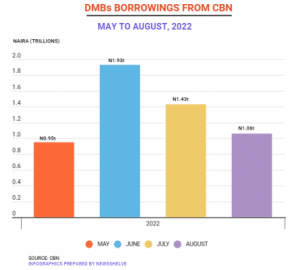

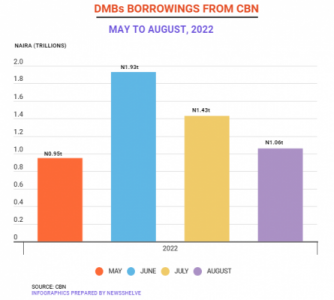

Deposit Money Banks (DMBs) borrowings from the Central Bank of Nigeria (CBN), through its overnight lending window, from June to August 2022, is valued at N4.4 trillion.

Data from the CBN indicates that Banks regularly access the Apex Bank’s Standard Lending Facility (SLF) to borrow funds, subject to some eligibility requirements, to address their short-term liquidity gap. Similarly, some of the lenders also leverage the Standing Deposit Facility (SDF) window to deposit excess cash.

Commercial banks in the country access SLF at 100 basis points above the monetary policy rate (MPR). In the case of SDF, lenders get the prevailing benchmark interest rate at minus 700 basis points (seven per cent).

According to the data, between June and August 2022, the total SLF stood at N4.44 trillion with June accounting for over 43.3 per cent of the total amount accessed in the period under review. The amount dropped from N1.93 trillion in June to N1.46 trillion in July, going down further to 1.06 trillion in August. In May, the SLF stood at N953.6 billion, only the figure to have doubled in June.

Analysts believe that the reflection seen in the last three months may have suggested a steady moderation in short-term liquidity challenges by the banks and could also suggest an aggressive reprising of risks by the banks.

Comment here