United Capital Plc has announced the appointment of four experienced infrastructure investment professionals as independent members of the Investment Committee of the United Capital Infrastructure Fund (UCIF), as part of efforts to reposition the fund for sustainable growth and expanded infrastructure opportunities in Nigeria and across Africa.

The appointments, which have been ratified and cleared by the Securities and Exchange Commission (SEC), are aimed at strengthening governance and enhancing the fund’s capacity to deliver long-term value.

UCIF currently has investments spanning power, industrial recycling and renewable energy, and has recorded a year-to-date gross return of 24.62 per cent.

Commenting on the development, Group Chief Executive Officer of United Capital Plc, Peter Ashade, said the appointments were made to further deepen the fund’s governance framework and sustain its impact-driven investment strategy.

According to him, the new members are expected to support UCIF’s mandate of achieving sustainable growth while delivering consistent value to investors.

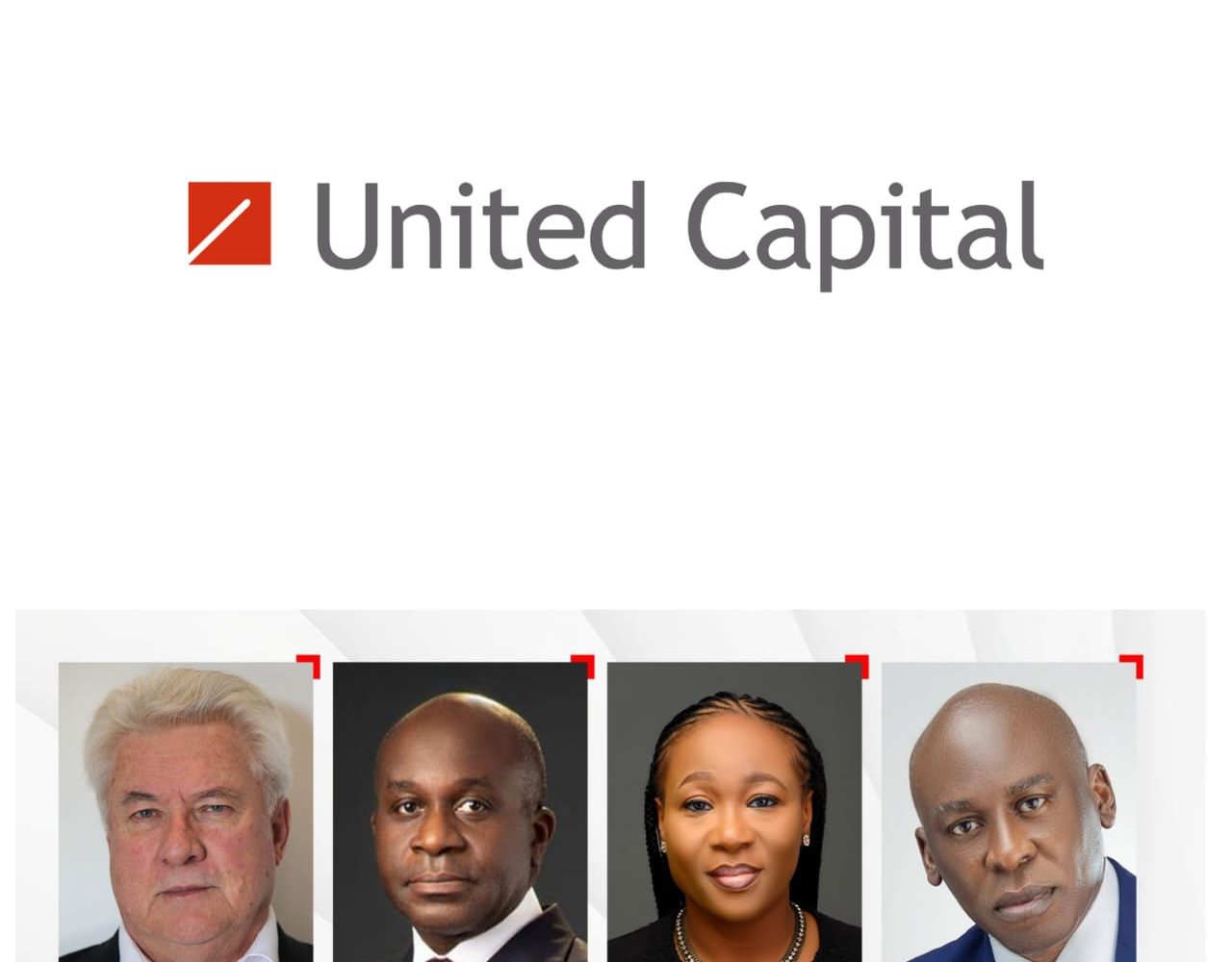

The newly appointed independent members are De Buys Scott, who will serve as Chairman of the Investment Committee, alongside Olubunmi Akinremi, Bola Bamidele and Obinna Ufudo. They join existing members of the committee, including Odiri Oginni, UcheNna Mkparu and Adeyinka Jafojo.

United Capital Plc also announced the exit of Samuel Nwanze from the Investment Committee following the completion of his tenure, expressing appreciation for his contributions to the fund’s rigorous investment processes.

Also speaking on the appointments, Chief Investment Officer and Fund Manager at UCIF, UcheNna Mkparu, said the fund was pleased to welcome the new members, noting that their extensive experience across multiple jurisdictions and strong professional reputations would help guide UCIF’s strategic direction as it scales investments across Nigeria and Africa.

De Buys Scott, the newly appointed Chairman of the Investment Committee, is the Managing Partner at Cornerstone Infrastructure Advisors and a former Senior Partner for Infrastructure at KPMG South Africa.

A Chartered Accountant, he brings extensive African and international experience in public-private partnerships, corporate and project finance, and capital raising across sectors such as transportation, healthcare and real estate.

Olubunmi Akinremi is the Chief Executive Officer of Tocam Capital and has over 30 years of experience in investment banking and corporate finance across Nigeria, the United States and the United Kingdom.

He has raised more than $5 billion for the Nigerian market and previously served as a Senior Special Adviser on economic policy to two Nigerian presidents.

Bola Bamidele, who recently retired from the World Bank Group after nearly 25 years, was the Sub-Saharan Africa Regional Lead for Transaction Advisory and Equity Mobilisation at the International Finance Corporation. She has extensive experience in structuring impact investments across Sub-Saharan Africa, Latin America, Asia and Europe.

Obinna Ufudo is a seasoned executive and board director with more than three decades of experience across banking, investment, infrastructure, energy and social impact.

He is a former President and Group Chief Executive Officer of Transnational Corporation of Nigeria Plc (Transcorp), where he led a turnaround that delivered over $1 billion in shareholder value within three years.

UCIF is a Securities and Exchange Commission-licensed, ₦150 billion closed-ended fund established to finance infrastructure and related projects across Sub-Saharan Africa.

The fund targets key sectors including agribusiness, industrial recycling, renewable energy, gas infrastructure, healthcare and manufacturing, with a focus on delivering competitive returns while supporting sustainable economic development.

Comment here